Understanding Allowances and Benefits in Payroll

Payroll is one of the most critical functions in any organization. It is not just about paying salaries but also managing allowances, benefits, deductions, taxes, and compliance with labor laws. Allowances and benefits are significant components of an employee’s total compensation package and directly impact motivation, engagement, and retention. Employers who manage allowances and benefits properly create a transparent and trustworthy work environment. Employees, on the other hand, can clearly understand their remuneration and perks. This article provides a comprehensive guide on payroll allowances and benefits, tax implications, recording practices, modern payroll methods, and how platforms like Paytime.pk simplify the process for Pakistani businesses.

What Are Allowances in Payroll?

Allowances are monetary benefits given to employees in addition to their basic salary. They are usually provided to cover specific costs like housing, travel, medical expenses, or other job-related expenses. In payroll, allowances are part of the gross salary and can be either taxable or tax-exempt based on local laws. Understanding allowances helps businesses structure compensation packages effectively while complying with tax regulations. Allowances also serve as an incentive and help employees manage their personal and professional expenses. Payroll teams must categorize allowances accurately to ensure correct salary calculations.

Types of Allowances

-

House Rent Allowance (HRA): HRA is one of the most common allowances provided to employees to cover housing costs. In many countries, including Pakistan, HRA can be partially exempt from income tax if certain conditions are met. This allowance encourages employees to relocate for work or manage rental expenses comfortably.

-

Travel Allowance (TA): Travel allowance covers costs incurred during business-related travel, such as transportation or fuel. Some organizations also offer travel reimbursement for daily commutes. Proper documentation of travel expenses ensures employees are reimbursed accurately without affecting payroll compliance.

-

Medical Allowance: Medical allowance helps employees cover health-related expenses that are not covered under health insurance. This allowance may include outpatient visits, medicines, or other health-related costs. Companies can provide a fixed amount or reimburse expenses based on actual claims.

-

Special Allowances: These include any additional compensation provided for specific roles, achievements, or responsibilities. Examples include skill-based allowances, project bonuses, or hardship allowances for employees working in challenging environments.

Types of Employee Benefits

While allowances are usually cash-based, benefits are non-wage compensations that provide value to employees over time. Benefits enhance employee well-being, improve engagement, and encourage loyalty. Unlike allowances, benefits may not directly increase take-home pay but add significant value to overall compensation.

Common employee benefits include:

-

Health Insurance: Health coverage for employees and their dependents ensures medical security and reduces financial burden from unexpected medical expenses.

-

Retirement Plans / Pension: Retirement benefits like pensions or provident funds help employees save for the future. Employers may contribute a certain percentage of salary to these accounts.

-

Paid Leaves (Vacation, Sick, Maternity/Paternity): Paid leaves allow employees to take time off without affecting their income. Proper management of leave benefits ensures compliance and employee satisfaction.

-

Performance Bonuses: Performance-based benefits reward employees for achieving targets or milestones, boosting productivity and engagement.

Providing comprehensive benefits improves employee satisfaction, reduces turnover, and enhances the organization’s reputation in the job market.

Tax Implications of Allowances and Benefits

Understanding the tax treatment of allowances and benefits is essential for accurate payroll management. Not all allowances and benefits are treated the same for taxation purposes.

-

Taxable Allowances: Some allowances, like special or skill-based allowances, are fully taxable and must be included in the employee’s income for tax calculations.

-

Exempt Allowances: Certain allowances, like HRA and travel allowances, may be partially or fully exempt if conditions set by the tax authorities are met.

-

Taxable Benefits: Monetary benefits such as performance bonuses or cash incentives are generally considered taxable income.

Payroll teams must calculate taxes accurately to avoid compliance issues. Employees should also understand which components of their compensation are taxable and which are exempt, helping them plan finances effectively. Proper tax treatment ensures fairness, compliance, and avoids unnecessary penalties.

How to Record Allowances and Benefits in Payroll

Recording allowances and benefits correctly in payroll is crucial for accurate salary disbursement, legal compliance, and financial reporting. Payroll professionals must categorize each allowance and benefit, determine taxability, and document them appropriately.

-

Categorization: Clearly distinguish between taxable and non-taxable allowances and benefits.

-

Automation: Use payroll software to calculate allowances, deductions, and taxes automatically, reducing errors.

-

Documentation: Maintain detailed records for auditing, employee queries, and compliance purposes.

-

Policy Updates: Regularly review payroll policies to reflect changes in labor laws or company regulations.

-

Transparency: Ensure employees have access to detailed salary slips, showing allowances, deductions, and benefits clearly.

Accurate recording prevents disputes, boosts trust, and ensures employees understand their full compensation.

Impact on Employee Compensation and Payroll Accuracy

Allowances and benefits directly impact both gross and net salaries. Gross salary includes all allowances and benefits, while net salary is the take-home pay after deductions and taxes. Accurate payroll ensures employees receive fair compensation, enhancing motivation and retention. Payroll errors, such as miscalculated allowances or benefits, can lead to dissatisfaction, complaints, and potential legal issues. Proper payroll management reflects organizational professionalism and trustworthiness. By regularly auditing payroll and using automated tools, businesses can maintain accuracy and efficiency in managing employee compensation.

Modern Payroll Practices for Managing Allowances and Benefits

Modern payroll practices focus on automation, compliance, and transparency. Payroll software helps streamline calculations, track allowances, and manage benefits effectively. Digital tools reduce manual errors, save time, and simplify reporting. Integration with accounting systems ensures accurate tax deductions and regulatory compliance. Modern payroll solutions also manage leave balances, bonuses, and insurance benefits efficiently. By adopting technology-driven payroll practices, organizations can provide better employee experiences and optimize operational efficiency.

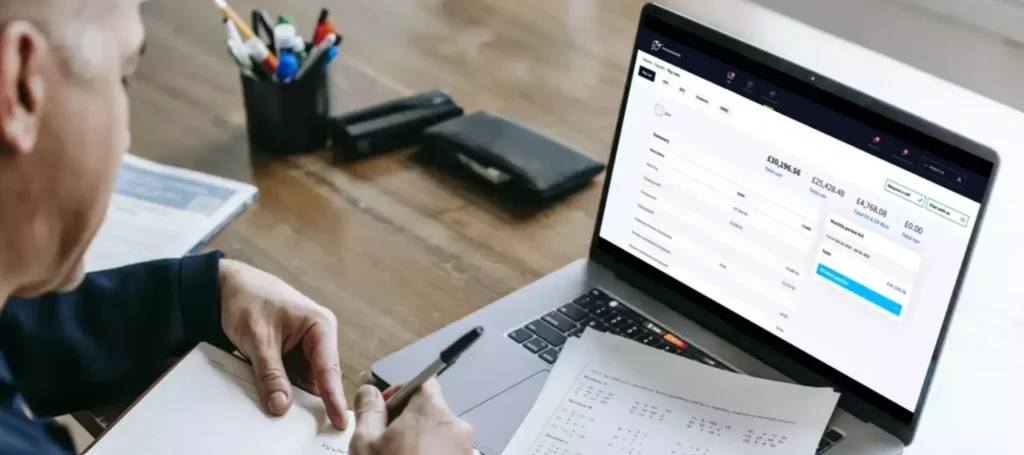

Why Paytime.pk?

Paytime.pk is a robust payroll management solution designed for Pakistani businesses. It automates salary calculations, allowances, overtime, and deductions according to local labor laws. Payroll reports can be generated instantly, ensuring compliance and transparency. Employees can view detailed salary slips, including allowances and benefits, providing clarity and trust. The platform reduces human errors, saves administrative time, and ensures accurate payroll management. Businesses using Paytime.pk experience improved operational efficiency, reduced compliance risks, and enhanced employee satisfaction.

Automated Salary Calculations

Manual payroll processes are prone to human errors and delays. Paytime.pk automates salary calculations, taking into account basic pay, allowances, overtime, and deductions. The system calculates salaries accurately each month, reducing the risk of errors and discrepancies. Automation saves HR departments countless hours, allowing them to focus on strategic initiatives rather than repetitive administrative tasks.

Compliance with Local Labor Laws

One of the most critical aspects of payroll management is legal compliance. Paytime.pk is designed specifically for Pakistan’s labor regulations, ensuring that salary calculations, overtime, deductions, and benefits align with government laws. Businesses can avoid fines, penalties, and legal disputes by using a system that automatically stays up-to-date with changes in labor policies.

Comprehensive Allowances and Benefits Management

Paytime.pk allows businesses to manage various employee allowances, such as transport, housing, medical, and special benefits. Employees can view detailed breakdowns of their salary slips, including all allowances and benefits, promoting transparency and trust. The platform ensures that employees are paid accurately, with no overlooked benefits, improving workplace satisfaction and loyalty.

Overtime and Deduction Management

Handling overtime and deductions manually can be cumbersome and error-prone. Paytime.pk simplifies this by automatically tracking overtime hours, calculating appropriate compensation, and applying any necessary deductions such as taxes, loans, or penalties. This ensures accuracy, compliance, and fairness in payroll processing.

Instant Payroll Reports

Generating detailed payroll reports manually can take hours. Paytime.pk provides instant reporting capabilities, allowing management to access payroll summaries, employee salary histories, allowance records, and deduction reports anytime. These reports help in financial planning, audits, and decision-making without delays.

Transparency and Employee Self-Service

Paytime.pk offers employees access to their own salary slips and payroll records through a secure platform. This transparency ensures that employees can verify their pay, allowances, and deductions. Self-service features increase employee satisfaction, reduce HR inquiries, and build trust within the organization.

Time and Cost Efficiency

By automating payroll, Paytime.pk saves significant administrative time and operational costs. Businesses no longer need to rely on manual calculations, spreadsheets, or external accountants for routine payroll tasks. This efficiency allows HR and finance teams to focus on higher-value activities such as strategic workforce planning.

Reduced Compliance Risks

Paytime.pk reduces the risk of non-compliance with labor laws by automatically incorporating statutory requirements. Whether it’s tax calculations, provident fund contributions, or overtime rules, the platform ensures that all payroll processes adhere to regulations, protecting businesses from legal complications.

Enhanced Operational Efficiency

Using Paytime.pk streamlines the entire payroll process, from salary calculations to reporting. Automated workflows minimize errors, improve accuracy, and reduce repetitive administrative tasks. Businesses experience smoother operations, faster payroll processing, and improved employee satisfaction, contributing to overall organizational efficiency.

Other Related Articles you may like to Explore

Conclusion

Allowances and benefits are crucial components of employee compensation that affect satisfaction, engagement, and retention. Accurate recording, proper classification, and transparent management ensure compliance with labor laws and minimize payroll errors. Modern payroll solutions like Paytime.pk automate these processes, making calculations easier and more accurate. Employers gain trust and loyalty from employees, while employees clearly understand their total remuneration. Adopting structured payroll practices strengthens organizational efficiency and builds a motivated, productive workforce.

FAQs

What is the difference between allowances and benefits?

Allowances are cash components of salary for specific purposes, while benefits are additional perks provided by the employer.

Are all allowances taxable?

No. Some, like HRA or travel allowances, may be partially or fully exempt depending on local tax laws.

How do benefits impact employee retention?

Comprehensive benefits improve satisfaction and loyalty, helping businesses retain top talent.

Can payroll software calculate allowances automatically?

Yes, platforms like Paytime.pk automate allowance and benefit calculations, ensuring accuracy and compliance.

Why is accurate recording of allowances important?

Correct records prevent disputes, ensure legal compliance, and provide employees clarity on compensation.